William Pitt the Younger (28 May 1759 – 23 January 1806) faced the same challenge as many prime ministers: how to make the budget balance. He had particularly large expenses because England was engaged in the French Revolutionary Wars (1792 – 1802). To fund these expenses Pitt introduced a series of taxes, some of which may seem rather obscure now. Hair powder was of interest to the treasury because it was typically used by the more wealthy members of society and thus was considered a luxury tax.

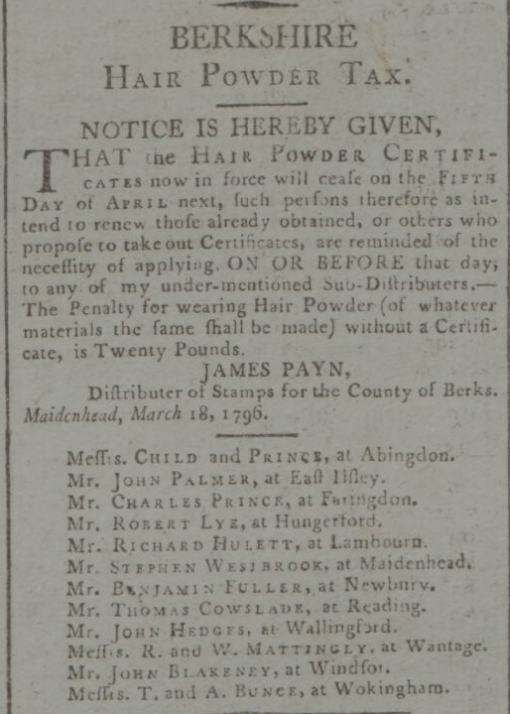

The Hair Powder Certificates Act was passed in 1795. The Act stated that everyone wishing to use hair powder must, from 5 May 1795, visit a stamp office to enter their name and pay for an annual certificate costing 1 guinea (the equivalent of about £100 in today’s money). Certain exemptions were included: the Royal Family and their servants; clergymen with an income of under £100 a year; and members of the armed forces, yeomanry, militia, fencibles, and volunteers. A father with more than two unmarried daughters could buy two certificates that would be valid for any number he stated at the stamp office. The master of a household could buy a certificate for a member of his servants, and that certificate would also be valid for their successors within that year.

Hair or wig Powder was used to volumise and sometimes to colour both wigs and later natural hair. Wigs had become a status symbol as well as a necessity in the 16th Century. Syphiliss had spread to England and so people afflicted with syphilis suffered all the effects, including sores and patchy hair loss which was in turn covered up with elaborate wigs.

Hairpowder was made from finely ground starch to which scents and colours were added. Fashions also changed including blue dye for women and pure white for men, worn in both natural hair and wigs.

So what does this have to do with Lambourn? Well, the good residents of Lambourn were also required to purchase Wig Powder certificates from Mr Mr Richard Hulett as set out in this 1792 newspaper article from the Berkshire Cronicle. He would collect the taxes and issue the certificates. We do not know very much about Richard and have to assume that he was associated with the local Justice of the Peace or Magistrate at the time.

The tax was not very popular however it did raise £200,000 in the first year (approx £3m in today’s money) for the treasury of England.

There was an almost immediate uproar against the tax with cartoons published in newspapers:

The act led to a rather rapid change in fashion: short hair was IN and by 1800 many men and women would be showing off a short natural coloured hair style.

The tax was in place until 1869 when it yielded just £1000 for the treasury. At that point the act was repealed.

Much later wartime once again drove the need to collect more tax and Purchase Tax was introduced in 1940 on the wholesale value of luxury goods. The stated aim was to reduce the wastage of raw materials during World War II and was initially set at a rate of 33⅓%. In 1973 it was replaced by value Added Tax (VAT) as we know it today.

Hair powder is less popular today however still very much available and, of course, taxed at 20% VAT.